Double materiality analysis

What is double materiality?

By double materiality, we mean that the world influences us and we influence the world, and both elements are equally important.

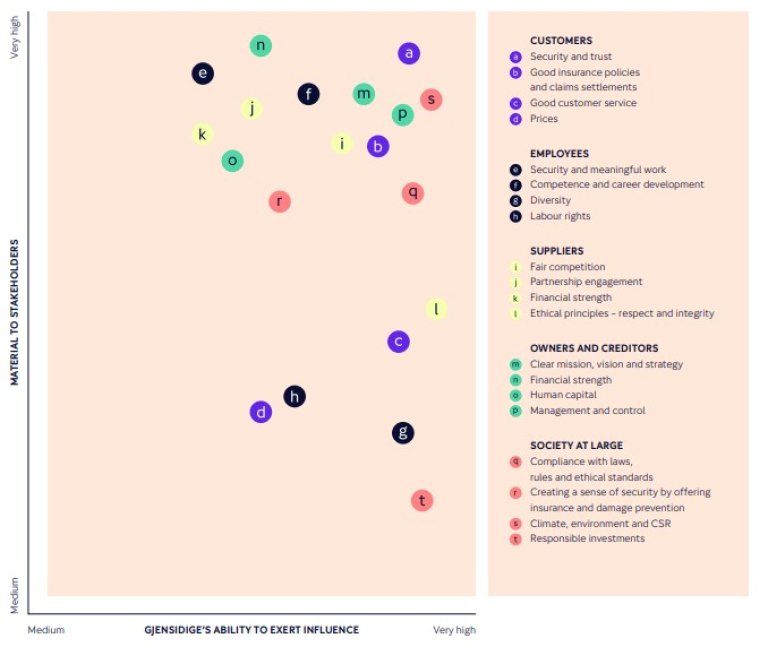

Gjensidige operates in seven countries, we are one of the most valuable companies on the Oslo Stock Exchange, and we have many different stakeholders. By stakeholders we mean those who influence or are influenced by the company. The materiality analysis is based on our stakeholders' expectations of us, and the interaction between us and them. The materiality analysis is based on customer satisfaction analyses, employee surveys, dialogue with suppliers and investors, developments in laws and regulations, and dialogue with the Financial Supervisory Authority. Through this process, we have formed a good opinion of which topics it is important to shed light on for the sake of our stakeholders. Significant topics from our stakeholders are shown in the figure below. This year's assessment of significant areas is considered not to deviate significantly from last year's review. Our dual materiality assessment is based on the principles of the TCFD framework.

| How the world impacts us | Material issues for our stakeholders | How we impact the world |

|---|---|---|

| Financial security is important to our customers and to society in general. | Security | Financial security is our core business activity. Helping customers understand and avoid risk is central to our strategy as a damage-preventing problem-solver. |

Our employees are concerned with safe workplaces and meaningful work that satisfies their need for competence and career development. Equal opportunities and rights are important.

Labour rights shall be safeguarded through the freedom of association. | Motivated employees | Human rights and labour rights are central to the dialogue with our employees. This is ensured through, among other things, meetings with employee representatives, and their participation on the Board. Health and safety work is important to ensure that our employees are safeguarded at work.

We work systematically to achieve greater diversity. We demand that our partners and the companies we invest in respect human and labour rights.

Engaged, motivated employees with high, updated expertise are decisive for value creation in the short and long term. |

Climate and nature-related risk is important to our stakeholders.

Employees are concerned with meaningful work and with contributing to solutions that reduce climate and environmental challenges.

Climate and environmental change will affect insurance directly through the likelihood of increased claims incurred (physical damage), greater uncertainty relating to the return on investments, and changes in customer preferences. | Climate and nature | We have established goals and targets that support emissions cuts to achieve the 1.5-degree target of the Paris Agreement.

Gjensidige has defined clear requirements of more climate and environmentally friendly solutions throughout the value chain. |

| Customers and other stakeholders increasingly expect the companies we invest in to take the climate and environment and social responsibility into account, and to exercise good corporate governance. The EU’s classification system for sustainable investments will also impact Gjensidige. The same applies to society’s expectations of large companies contributing capital to succeed in the transition to a green economy. | Responsible investments | The Board has adopted clear requirements of our capital management. We must comply with the 10 UN Global Compact principles for climate and nature, social responsibility and corporate governance. This is continuously monitored to ensure that the companies we invest in give necessary consideration to sustainability. That way, we help ensure capital is shifted to companies that take social responsibility and contribute to net zero emissions by 2050. |

| Insurance is subject to stringent regulation and licensing because of the social impact of the business. Good management and control is a critical success factor for safeguarding life, health and assets. Direct and indirect taxes that finance the common good are also an important contribution. | Good management and control | In addition to complying with external and internal rules, decisions and actions shall also be in line with Gjensidige’s values and Code of Conduct, in a manner that creates and preserves value for customers, owners, employees and society at large. |

Stakeholder dialogue and risk and materiality assessment

We adopt goals, targets and strategies to ensure value creation in the long term. To ensure our goals and strategies are aligned with stakeholder expectations, we carry out a materiality assessment each year. This is developed in dialogue with customers, employees, suppliers, financial market participants and representatives of society.

The ranking is based on what topics the stakeholders consider important, and the consequences for Gjensidige if we fail to meet their expectations.

We have summarised our risk and materiality analysis and stakeholder needs in five areas:

- A safer society

- Motivated employees

- Climate and the environment

- Responsible investments

- Good governance and control

These areas are described in the figure. Gjensidige's value creation in these five areas is described in more detail in separate chapters in our annual report.